What is a Gann Swing Chart?

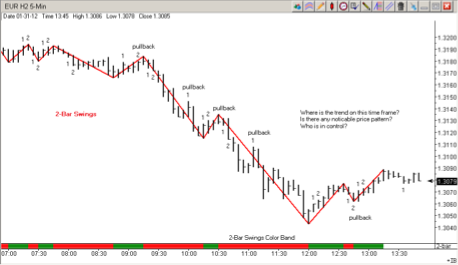

One of the simplest of Gann’s methodologies is the use of a swing chart pattern as a study of market swings that takes advantage of the tendency for prices to ebb and flow in the short-term. The construction of a swing chart results in what Gann called a trend line indicator that is based on price movement on a bar-by-bar that is constantly evolving. And I have this to say that it is a good and simple price based method for objectively defining market short-term price direction, whether the trend in force is likely to continue or is there a sign of a reversal are present and for any pullback analysis with noticeable price pattern (between 1 and 3-days/bars or periods) in an underlying strong trend. Using the high and low for the price bar or period, whichever exceeds the previous x-bar or x-period becomes the trend line indicator.

In a nutshell, market swings are the true reflection of price movement and that means we can all know that “Price tells the trend”. It’s the simplest way to keep our mind focused on market direction at the beginning of a new swing and exiting at or near the end of that swing to await the development of a new swing trading opportunity. And finally, swing charts help filter out market noise with significant swing pivot highs and swing pivot lows as peaks and valleys on the chart for easier identification of support and resistance, especially with price levels traders.

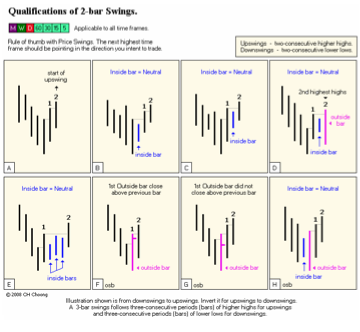

I have listed the qualifications of a 2-Bar Swings below and I hope it helps you re-discover this simple and effective method for defining market trend that is purely based on price behaviors without any optimization.

Qualifications of 2-Bar Swings.

From downswing to upswing: Two-consecutives bars or periods of higher highs will start the upswing.

From upswing to downswings: Two-consecutives bars or periods of lower lows will start the downswing.

Inside bar: All inside bars, including equal high or equal low inside bars, are neutral and they are not counted. We are only interested in price making x-bar higher highs for upswing and price making x-bar lower lows for downswing.

Outside bar: From downswing to upswing: Outside bar close must be above prior bar high to be valid as 1st upswing.

From upswing to downswing: Outside bar close must be below prior bar low to be valid as 1st downswing.

Special Case with breakout of nearest swing pivot high or swing pivot low: This option takes large price movements into consideration if the high or low of a swing pivot is broken before the set number of x-bars has occurred.

For example, with 2-bar Swings, an extreme price range occurs on the 1st upswing or 1st downswing. Normally this would not be considered until the 2nd bar/period had formed to make a complete swing pivot where as the breakout rule takes this extreme price movement into consideration straight away. If not, we will missed the significant swing pivot high or low.’

Examples of 2-Bar Swings and 3-Bar Swings